Any seller who runs their store as a money-making business has to pay taxes on what they earn through the platform. If you and the IRS classify your eBay sales as a hobby, you’ll have to report the income on Form 1040. For tax years prior to 2018, you report your expenses as an itemize deduction on Schedule A. Beginning in 2018, you are no longer eligible to take a deduction for hobby expenses. Not every eBay sale is subject to income tax, but most are. If you use the site to get rid of household articles you’ve used in the past, you may qualify for “occasional garage or yard sale” treatment.

We will touch briefly on the difference between income and sales tax, but with sales tax being the beast that it is, we have a dedicated guide to that here. And, if you’re looking for a guide on VAT for eBay and UK sellers, check out ours here. One of the most common forms of tax that e-commerce companies need to be aware of when selling on eBay is income tax.

TURBOTAX ONLINE/MOBILE PRICING:

Some states already require businesses like Venmo and Etsy to send 1099-K forms to customers who receive relatively small amounts of money. According to payment platform Stripe, the threshold is $600 in Maryland, Massachusetts, Mississippi, Vermont, Virginia, and the District of Columbia. And it is $1,000 in New Jersey, $1,000 and at least four transactions in Illinois, and $2,500 in Arkansas. If you make sales for profit on eBay or get paid for tutoring math on Venmo, you will need to account for that income when you file your taxes. Here’s what to know about side income and when you may owe taxes. The old law, which still applies to money earned through 2022, said platforms had to send 1099-Ks only if a user received more than $20,000 in revenue and had more than 200 transactions.

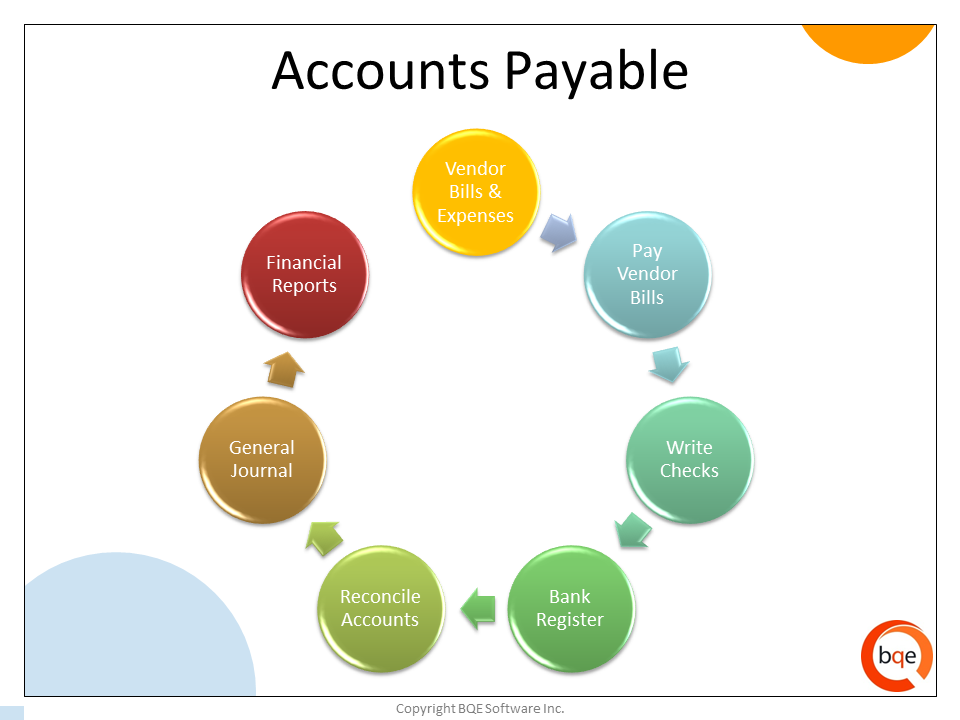

An IRS Form 1099-K tracks payments received through third-party payment methods/ transaction networks such as Venmo, credit card, PayPal, and other payment methods. In addition, Form 1099-K does not include the sales tax when it is automatically collected by eBay. Later in the article, we’ll talk about where to find eBay’s collected sales tax info. The 1099-K is an information return that reports the gross amount of all reportable payment transactions from eBay within a calendar year i.e. discounts, credits, fees, refunds, and other adjustable amounts. If you’ve had a successful year with your ecommerce business, it’s time to ensure you’re fully prepared to file your ecommerce taxes. The IRS is paying attention to your income, so it’s important to make sure you comply and avoid any IRS tax penalties.

You may need to make estimated-tax payments

Searches 500 tax deductions to get you every dollar you deserve. We guarantee personal, one-on-one attention to each and every client. Our attorneys have decades of experience in the complex fields of tax law, cryptocurrency, marketing law, and more. A 1099-K from Facebook will show the gross receipts of customers who used third-party settlement organizations like PayPal. In a bid to alleviate some concerns, some House Democrats introduced legislation to raise the tax threshold to $5,000 earlier this year. Earlier this year, a bipartisan attempt by Republican and Democratic senators to increase the threshold further to $10,000 failed.

Quotes displayed in real-time or delayed by at least 15 minutes. They are a reseller and have presented a valid resale certificate. Hobby- if the intent of your selling is not with the intent to turn a profit. To see the entire prior years’ worth of data, you can simply select Last Year and then click the Generate Report button.

eBay Main Street

The $500 difference is considered taxable income and the IRS expects you to report this income on your tax return. You might need to file sales tax returns, depending on each state and your business’s individual circumstances. The state of South Dakota went so far as to take a case regarding ecommerce sales tax all the way to the Supreme Court. This means states now have much more leeway when it comes to requiring online sellers to collect sales tax. Individual states can now require sellers to collect sales tax based on the number and value of sales to the state, called economic nexus, not just physical presence. Yes, eBay charges sales tax on many purchases on behalf of the seller, without the seller setting up anything at all.

IRS Delays $600 Tax Rule for Venmo, eBay Sellers – PCMag

IRS Delays $600 Tax Rule for Venmo, eBay Sellers.

Posted: Wed, 28 Dec 2022 08:00:00 GMT [source]

If you’re a Facebook or eBay seller, you will receive Form 1099-K if you meet certain gross sales and transaction thresholds. Similar to Facebook Marketplace and eBay,Etsy tax forms include 1099-K and 1099-MISC. You may receive one of these forms if your sales exceed the general threshold of $20,000. The specific nexus rules for online sellers vary by state and may depend on the number of sales and transactions made in the state. You are a marketplace seller if you make retail sales through either a physical or electronic marketplace operated by a marketplace facilitator.

If you do not have physical presence How To File Taxes For Ebay Sales in Washington, you are a remote marketplace seller. “EBay believes in following the law and proper tax accounting,” said an eBay spokesperson. “Sending confusing 1099-Ks to nearly every occasional or casual seller that uses an online platform to earn extra income, however, is not the right approach.” Not all online sales are taxable, whether you receive tax form or not. If you are required to collect eBay sales tax in a state for which eBay does not collect on your behalf, then you should fill out the tax table that eBay provides to let them know how much to charge.